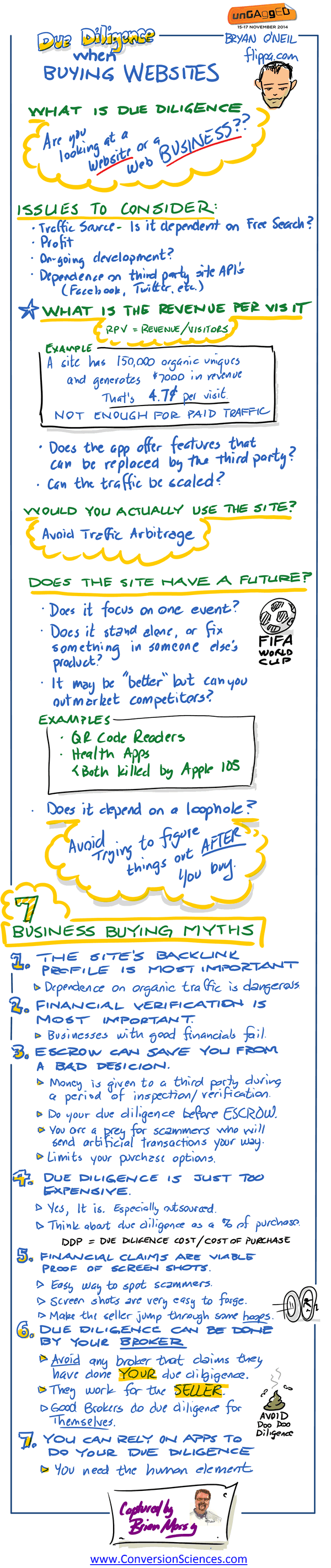

Website Due Diligence: Avoid Doo Due Diligence When Buying Websites [INFOGRAPHIC]

All you ever wanted to know about performing website due diligence and how to not doo due diligence when buying sites.

I’m at the Ungagged Conference and enjoyed sitting in on a presentation by Bryan O’Neil of Flippa.com.

Are you looking for a Website, or a Web Business?

— Bryan O’neil, Flippa.com

Website Due Diligence Issues to Consider

When considering investing in a web business, consider the following.

- Traffic source: Is it dependent on free search?

- Proft

- On-going development: Does it require additional investment?

- Dependence on Third-party API’s: Facebook, Twitter and others can change access to data at any time.

There are other considerations for website due diligence as well.

Calculate Revenue per Visit

The Revenue per Visit (RPV) is the revenue generated by a site divided by the number of visitors. If this number is small, you may have trouble building traffic, because the cost of the traffic is higher than the revenue.

For a better analysis, consider measuring Profit per Visit.

Avoid Traffic Arbitrage

If the site is not something you would use, you might have a business built on traffic arbitrage. Arbitrage is acquiring traffic, and then sending it advertisers or affiliates for more than you paid.

This is not a web business.

Does the Website have a Future?

Sites with a limited future are not a good long-term investment. When performing website due diligence, be careful of sites that are at the mercy of time or other businesses.

Websites that focus on a single event have a built in expiration date.

Sites that fix something in someone else’s product can be eliminated by upgrades to that product.

Sites tat provide a product that is simply “better” than the competition can be marketed out of existence

Websites that depend on loopholes should be avoided, as loopholes can be closed.

Avoid trying to figure things out after you buy.

— Bryan O’neil, Flippa.com

Website Due Diligence: 7 Business Buying Myths

O’Neil offer seven myths about buying a business that you should avoid.

Myth #1: The site’s backlink profile is important

Dependence on organic traffic is dangerous.

Myth #2: Financial verification is most important

Businesses with good financial verification can fail if they don’t have a future.

Myth #3: Escrow can save you from a bad decision.

Escrow is where you give money to a third party during a period of inspection and verification.

Do your due diligence before you enter escrow. Don’t make yourself a target for scammers.

Entering escrow also tie up your capital, limiting your options.

Myth #4: Website due diligence is just too expensive.

Due diligence is expensive, especially if done by a third party.

But, when you compare it to the purchase price, it can be quite affordable.

Calculate your Website Due Diligence Percent:

DDP = Cost of Due Diligence / Purchase Price of Website.

Myth #5: Screen shots are viable proof of financial performance.

Business owners can forge screen shots showing success. This is a sign of a scammer.

Make the seller jump through hoops.

— Bryan O’neil, Flippa.com

Myth #6: Your broker can do due diligence.

Avoid any broker that claims they have done due diligence for you.

Brokers work for the SELLER.

Myth #7: You can rely on apps to do your website due diligence.

Nope. You need the human element in the process.

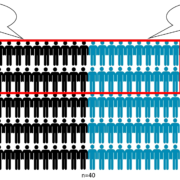

Due Diligence when Buying Websites by Bryan O’neil of Flippa.com

Here is my instagraph infographic of his presentation on due diligence mistakes when buying Websites.

![Wasp-Redesign-Process_thumb[1] The Waspbarcode.com redesign process.](https://conversionsciences.com/wp-content/uploads/2015/05/Wasp-Redesign-Process_thumb1-180x180.gif)